What is the real meaning of “Retirement Planning”?

By Evans Taylor - Senior Financial Planner New England Financial

Retirement should be a time to enjoy all that you have worked so long to accumulate. It should be a time for indulging in life’s pleasures and for making sure that everything is checked off your lifelong to-do list. However, this is not always easy because it requires transitioning from a financial philosophy of accumulation (saving) to one of distribution (spending).

Spending what has been saved brings with it a fear of someday running out of money due to stock market volatility, inflation, taxes, and rising health care costs. Because of this fear, very few are able to make the transition into distribution and enjoy a comfortable retirement lifestyle despite the fact that they have adequate resources to do so.

With millions of baby boomers nearing retirement, many are wondering if they can afford to retire now or need to work longer. Since most companies are moving away from defined-benefit plans that provide retirees with a monthly benefit, other investments in an individual’s retirement portfolio begin to play a larger role in covering the costs of their retirement years. This makes it increasingly important that these other investments are managed properly to maximize their returns while controlling their risks. Too often, people continue to invest the same way during retirement as they did before they retired.

A qualified financial planner could be the best answer to these concerns. While most financial resources focus predominantly on retirement accumulation, a qualified financial planner who is experienced in working with clients in the distribution phase can help to provide an understanding of “retirement distribution”. This is the process by which people arrange for the utilization of their assets during life with the least amount of financial and emotional costs.

Having a Retirement Distribution Assessment done is the best way to navigate through this phase of life. This assessment, as part of a comprehensive Financial Plan, will provide direction and help to determine the best method of distribution based on individual needs and desires. It will also answer the three most common retirement questions:

1. When can I afford to retire?

2. How much will I get?

3. How long will it last?

Investing some time in fully understanding your retirement situation allows you to develop a strategy for leading a Life of Significance and provides the peace of mind to live worry free!

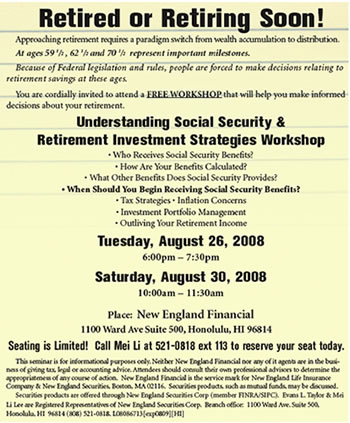

To arrange a complimentary meeting to review your financial and retirement arrangements, call 521-0818 ext 113 or attend our next free workshop. Evans L. Taylor is a Senior Financial Planner with over 18 yrs in the financial service industry. He develops financial plans for those near or in retirement to better understand their retirement potential. His professional education includes earning the CERTIFIED FINANCIAL PLANNER certificate from the Financial Planning Board of Standards.

E-mail this story | Print this page |

Comments (0) | Archive |  | RSS

| RSS

Most Recent Comment(s):

Del.icio.us

Del.icio.us