Financial Strategy Of The Month: Planning A Smart IRA

Mark Teruya

If you own an IRA or have another retirement account, the words that follow may ring a bell, especially if you’ve been contributing to a retirement account for a long period of time.

Think back to when you first started investing in the account. Remember what you were told? See if this sounds familiar:

Put money away today in a retirement account and you’ll be able to use your contribution as a tax deduction against your other income.

Invest the contribution that you made to the retirement account wherever you want and the growth on that contribution will grow tax deferred.

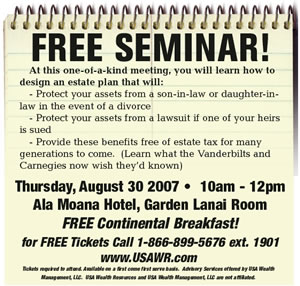

{embed=“elements/box_ad”}

When you retire, and begin to take withdrawals from your retirement account, you’ll be in a lower tax bracket since you’ll be retired which means that you’ll be able to put money away on a tax deductible basis when you’re in a higher tax bracket and take money out during retirement when you’re in a lower tax bracket.

Assuming that you were told all three of these things when you started to contribute to a retirement plan, my question for you is this: Were all three things true?

My experience working with clients tells me that in many cases only 2 of these 3 things were proven true - number 3 above, for may clients, was not.

Don’t get me wrong, IRAs and retirement accounts are useful products, but many folks who put money away in one tax bracket while they were working are now retired and drawing money from these retirement accounts only to find that they’re actually in a higher tax bracket now than they were when they were putting the money away.

Why did that happen?

It could be a number of reasons, but in many cases the culprit is the fact that the Internal Revenue Code, the rules that the tax ‘game’ is played by, changed.

In fact, under today’s tax code, if your estate is large enough, up to 65%* of your IRA could be lost to tax at death, unless, you do the appropriate planning.

That’s where the SmartIRA planning strategy may come in. The SmartIRA planning process is designed to reduce, or, in some cases, even eliminate taxes on a client’s IRA. However, the outcome of the strategy is dependent upon the circumstances of your individual situation, so results will vary.

If you have an IRA, you may want to get more information about the SmartIRA planning process. Please contact our offices for more information.

Special Note: With Traditional IRAs Early withdrawals may be subject to a surrender charge. In addition, distributions prior to age 59 ? may be subject to a 10% tax penalty.

E-mail this story | Print this page |

Comments (0) | Archive |  | RSS

| RSS

Most Recent Comment(s):

Del.icio.us

Del.icio.us