Page 3 - MidWeek - Dec 29, 2021

P. 3

December 29, 2021 MIDWEEK 3

Four Things to Consider Before Buying A Home

by Vim Balantac

Hawaii State FCU, Vice President Mortgage Loan Originator Manager

Buying a home in Hawaii is a big investment. It involves a lot of time, research, and most importantly, finances. Making sure that you and your family are prepared

for a significant commitment such as this involves considering all of the potential impacts a large purchase can make in your life, not only financially, but emotionally as well. Here are four important things you can do to prepare before buying a home.

1) Have the right people in your corner.

It’s essential to have a great realtor, but also make sure you have a Mortgage Loan Originator that you trust who can help you step by step through the mortgage loan process from application to closing.

2) Know what you can afford.

Avoid disappointment and unrealistic expectations by finding out what you qualify for before you start shopping. Figuring out how much you can afford while still living within your means is key.

3) Prepare yourself emotionally.

Buying a home, like any major life event, comes with emotional highs and lows. You’re not alone – a lot of people experience this as they go through the homebuying process. Stay positive, remain flexible,

and be willing to compromise.

4) Start saving NOW.

There are a lot of costs that go into buying a home outside of the actual purchase price. Build up savings early so you’re better prepared for when you become

a homeowner.

Hawaii State FCU offers a number of home financing and refinancing options to

meet your unique needs. From first-time homebuyers, to veterans and seasoned buyers, our experienced team of mortgage loan officers can help. For more information, make an appointment online at www.HawaiiStateFCU.com.

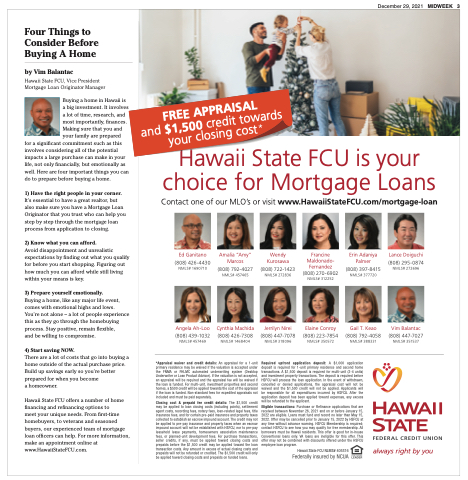

Hawaii State FCU is your choice for Mortgage Loans

Contact one of our MLO’s or visit www.HawaiiStateFCU.com/mortgage-loan

Ed Ganitano

(808) 426-4430 NMLS# 1690710

Angela Ah-Loo

(808) 439-1032 NMLS# 457469

Amalia “Amy” Marcos

(808) 792-4027 NMLS# 457465

Cynthia Machida

(808) 426-7308 NMLS# 1468404

Wendy Kurosawa

(808) 722-1423 NMLS# 272836

Jerrilyn Nirei

(808) 447-7078 NMLS# 318096

Francine Maldonado- Fernandez (808) 270-6902 NMLS# 312252

Elaine Conroy

(808) 223-7854 NMLS# 350572

Erin Adaniya Palmer

(808) 397-8415 NMLS# 377720

Gail T. Keao

(808) 792-4058 NMLS# 388331

Lance Doiguchi

(808) 295-0874 NMLS# 272696

Vim Balantac

(808) 447-7027 NMLS# 351537

*Appraisal waiver and credit details: An appraisal for a 1-unit primary residence may be waived if the valuation is accepted under the FNMA or FHLMC automated underwriting system (Desktop Underwriter or Loan Product Advisor). If the valuation is not accepted, an appraisal will be required and the appraisal fee will be waived if the loan is funded. For multi-unit, investment properties and second homes, a $500 credit will be applied towards the cost of the appraisal if the loan is funded. Non-standard fees for expedited appraisals not included and must be paid separately.

Closing cost & prepaid fee credit details: The $1,500 credit may be applied to loan closing costs (including points), settlement agent costs, recording fees, notary fees, loan-related legal fees, title insurance fees, and for certain pre-paid insurance and property taxes collected to establish an escrow impound account. The credit may not be applied to pre-pay insurance and property taxes when an escrow impound account will not be established with HSFCU, nor to pre-pay leasehold lease payments, homeowners association maintenance fees, or planned-unit development fees. For purchase transactions, seller credits, if any, must be applied toward closing costs and prepaids before the $1,500 credit may be applied toward the loan transaction costs. Any amount in excess of actual closing costs and prepaids will not be refunded or credited. The $1,500 credit will only be applied toward closing costs and prepaids on funded loans.

Required upfront application deposit: A $1,000 application deposit is required for 1-unit primary residence and second home transactions. A $1,500 deposit is required for multi-unit (2-4 units) and investment property transactions. The deposit is required before HSFCU will process the loan application. In the event of withdrawn, cancelled or denied applications, the appraisal cost will not be waived and the $1,500 credit will not be applied. Applicants will be responsible for all expenditures incurred by HSFCU. After the application deposit has been applied toward expenses, any excess will be refunded to the applicant.

Eligible transactions: Purchase or Refinance applications that are received between November 26, 2021 and on or before January 15, 2022 are eligible. Loans must fund and record no later than May 15, 2022. Offer may be cancelled prior to January 15, 2022 by HSFCU at any time without advance warning. HSFCU Membership is required; contact HSFCU to see how you may qualify for free membership. All borrowers must be Hawaii residents. This offer is good for in-house Conventional loans only. VA loans are ineligible for this offer. This offer may not be combined with discounts offered under the HSFCU employee loan program.

Hawaii State FCU NLMS# 405316

FREE APPRAISAL and $1,500 credit towards your closing cost